NAVIGATION

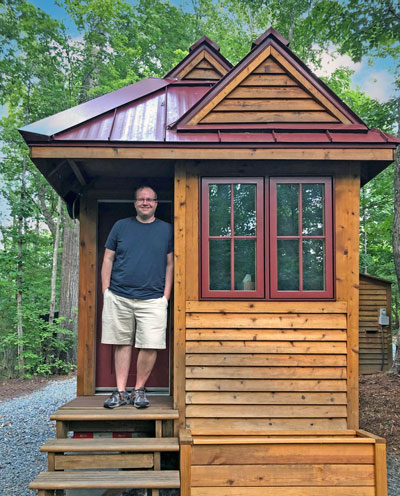

Hi, I’m Ryan

When I first moved into my tiny home, insurance options for tiny homes weren’t even a thing. Now there are many options for tiny home insurance, which is a testament to just how many people are waking up to the tiny life.

Tiny House insurance is one of those things that comes up once you start to think seriously about living in a tiny home. With any investment like a house, you have a lot to lose if something were to happen. Getting your tiny home insured with a homeowners insurance policy can be tricky.

So, what is the deal with tiny home insurance policies and what insurance companies offer them?

Can you insure a tiny home?

Yes! Tiny house insurance is now available through a variety of companies including Geico, State Farm, Progressive, Lloyds of London, and Allstate.

It’s important to note that you really need to pay attention to the details, because policies vary dramatically and what coverage is provided does too. There are often a lot of exceptions that are baked into underwritten policies, so at a minimum you need to be aware of them.

How To Insure A Tiny House On Wheels

In some cases, you won’t be able to cover a tiny home with a standard home insurance policy. However, you might be able to insure your tiny home as a mobile or manufactured home insurance policy.

A great resource on this is our post about Appendix Q, my eBook on Tiny House Build Codes, and our state guides. Once you have a good handle on how your state classifies, then you can start to reach out to the below insurance companies and talk to them about a tiny house insurance policy.

If I Also Own A Traditional House, Can I Add A Tiny House To The Policy?

I’ve found that it is a mixed bag when it comes to adding a tiny house onto your existing traditional home insurance policy. In some cases yes, in others no. You’ll need to talk to your insurer to get a clear picture.

Does Standard Homeowners Insurance Cover Tiny Homes?

In general, a standard homeowners insurance policy does not cover a tiny house. There are exceptions, but generally it doesn’t.

Tiny House Insurance Cost

The cost of an insurance policy will vary based on several factors and with which company you plan to purchase a policy through. It will also matter how much you move your tiny home. In many cases, tiny home insurance policies will not cover the house while transporting the house from one location to another.

For transportation insurance, that will most likely come from either your car insurance policy or through the transporter you hire for the job. Read more about towing a tiny house here.

How Much Does Tiny House Insurance Cost By Company

| Insurance Company | Tiny House Value | |||

|---|---|---|---|---|

| $10,000–$30,000 | $30,000–$70,000 | $70,000–$100,000 | $100,000+ | |

| Geico Tiny House Insurance | $435 | $575 | $684 | $789 |

| State Farm Tiny House Insurance | $545 | $698 | $754 | $851 |

| Progressive Tiny Home Insurance | $512 | $634 | $697 | $879 |

| Allstate Tiny House On Wheel Insurance | $542 | $684 | $754 | $815 |

| Lloyds of London THOW Insurance | $687 | $724 | $789 | $862 |

| Foremost RV & Tiny House Insurance | $489 | $584 | $645 | $756 |

| Liberty Mutual THOW Insurance | $512 | $634 | $754 | $815 |

| American Modern Tiny Home Insurance | $489 | $584 | $645 | $789 |

Costs above are estimate annual insurance premiums

Tiny House Insurance Companies

Every day, more and more insurance companies are opening up policy options for tiny homes. Here is a list of what I’ve found:

Geico Tiny Home Insurance

Most polices for tiny homes goes through Geico’s mobile home insurance.

State Farm Tiny House Insurance

The State Farm representative I spoke with said an RV policy was the most likely option.

Progressive THOW Insurance Policies

Progressive will often give a traditional home insurance policy while your house is stationary.

Allstate Tiny House Insurance

Allstate handles tiny homes on wheels as a manufactured or mobile home in most cases.

Lloyds of London Insurance For Tiny Homes

Lloyds will insure many things including a tiny home. You’ll need to find a local rep to get a policy.

Foremost RV & Tiny House Insurance

Foremost offers insurance for tiny homes alongside its RV policies.

Liberty Mutual THOW Insurance

Liberty Mutual has started offering options through its mobile home policies

American Modern Insurance Group (AMIG) Tiny Home Policies

AMIG now offers policies through their manufactured home policies.

Your Turn!

- Are you going to insure your tiny home?

- What do you think about tiny house insurance costs?

I build a tiny house on a 1980 lb trailer, the house was 60 sf and I tried to get insurance from 4 different insurance company 2 of them you listed. All 4 company said that the house had to be certified by NOAH Certification or they will not insured the house. The house is already completely built. The company they told me they wanted certified was based in Fla. so guess I will be tearing the house apart because that company requires the house to be inspected in all phases of construction by there people. I am a carpenter by trade

Geico does not insure THOW only if you remove the wheels. This is what I was told today 10/17/23

Correction, shortly after posting this I received a call from Geico advising they do insure THOW!