NAVIGATION

I owe a lot to the slow money mindset. I get to feel good about what I have and where I’m at instead of chasing the latest new thing or the next big promotion. I’m happy, I’m invested in my community, and I get to live the lifestyle I want without comparing it to everyone else’s. If that isn’t the actual American Dream, I think it should be.

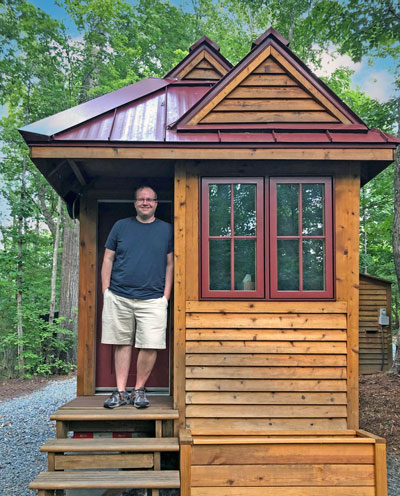

Hi, I’m Ryan

For me, life isn’t about accumulating more stuff. As a minimalist and a slow living enthusiast, I believe in living an intentional, slow money lifestyle that benefits my own happiness and my own local community instead of a lifestyle of blind competition with the Joneses.

What Is Slow Money?

In a nutshell, slow money is a mindset that shifts you away from materialism and toward meaningful fulfillment. Most of us are geared toward a life of chasing material wants. We’re taught to follow a path toward more stuff and better things. And once we have them, we need more and better after that. The cycle never ends.

Slow money asks you to evaluate yourself and your philosophy of money to see if a never-ending pursuit of more is what will really bring you happiness and contentment. Do you want to spend your life chasing bigger and better, or live sustainably, happily and generously with what you have? Do you want to thoughtlessly pour your money into big, cookie-cutter companies that generate waste and work against small town economies, or do you want to support your local community?

Slow money asks you to evaluate yourself and your philosophy of money to see if a never-ending pursuit of more is what will really bring you happiness and contentment. Do you want to spend your life chasing bigger and better, or live sustainably, happily and generously with what you have? Do you want to thoughtlessly pour your money into big, cookie-cutter companies that generate waste and work against small town economies, or do you want to support your local community?

Moving toward a less consumeristic, more intentional way of making and spending money really is a big shift, but that’s slow money. And let me tell you, it’s worth it.

About The Slow Money Institute

You can’t do a Google search about slow money without running into the Slow Money Institute. This non-profit started by Woody Tasch has locations all over the place (kind of similar to Slow Food), and the people running it do a great job of encouraging and organizing the support of local economies and local food systems. Perusing their website will give you a good idea of how the concept of slow money got started.

“Slow Money is basically two things. It’s a new vision of reconnecting money to the soil and investors to local economies, and it’s the network of people who are bringing those ideas into action.”

– Woody Tasch, Slow Money Institute

Principles And Characteristics Of Slow Money

The Slow Money Institute has an excellent list of principles that they and their investors hold to. When it comes to my own life, however, I’ve found that an overall philosophy of slow living has bled over into specific areas like money, and has slowly shaped my own guiding principles.

My Slow Money Principles

- Choosing to invest in a fulfilling life rather than a life of accumulation.

- Intentionally supporting local business and agriculture to help local communities thrive.

- Spending carefully to prevent waste and promote a slow lifestyle.

- Adapting my work life to build a satisfying lifestyle rather than pouring my life into work.

Fast Money Vs. Slow Money: What’s The Big Deal?

In our modern world, fast money feels like an inescapable presence in the overarching global economy. Unfortunately, big companies are largely focused on consumption and profit, which doesn’t do any favors for local and small communities. Slow money, on the other hand, is all about the preservation and restoration of local communities and economies.

Putting our money back into the farms producing food near us is a good slow money investment. Similarly, putting money back into the community where our children will grow up is a good slow money investment that also builds a revenue of enjoyment and success right where we’re at.

Putting our money back into the farms producing food near us is a good slow money investment. Similarly, putting money back into the community where our children will grow up is a good slow money investment that also builds a revenue of enjoyment and success right where we’re at.

There is a famous parable about a fisherman. Every day, he catches only enough fish to provide for his family’s immediate needs and spends most of his time with loved ones doing the things that make him happy. A vacationing investment banker pitches the fisherman a 20-year business plan that could make him millions, allowing him to eventually retire to a life identical to the one he already leads (20 years down the road).

The fisherman isn’t fooled, and we shouldn’t be fooled by high-stress, money-making schemes either. I love this story because it sums up the powerful punch of a slow money lifestyle better than I ever could.

Why Slow Money Isn’t All About Money

If you’re at all familiar with the slow living mindset, you’ll know that any aspect of slow living, slow money included, is all about enjoying life to the fullest. That means that slow money isn’t about making more money, it’s about making more out of the money you have.

Like that fisherman, we shouldn’t chase after wealth simply because we can if we’re already living the life we want. What is the point, after all? The point of money is to support your life — don’t set it on a pedestal.

“The greatest wealth is to live content with little.”

– Plato

Tips For Starting Your Slow Money Journey

I’m often asked for advice on money because of my own financial journey. I started adult life with a bunch of student loan debt and a job that was barely paying the bills. My sense of what financial security meant was shaken by the 2009 recession, and I began searching for a new type of security — a lifestyle that would be more peaceful, more sustainable, and more enjoyable.

I eventually stumbled upon a picture of a little house built on a trailer, and my dream of building my own tiny home took root. It took me four years of working, planning and saving to make my dream a reality. Over those four years I worked my way up, tackled my debt, sacrificed for my dream, and in late 2012, I started building my tiny house.

I eventually stumbled upon a picture of a little house built on a trailer, and my dream of building my own tiny home took root. It took me four years of working, planning and saving to make my dream a reality. Over those four years I worked my way up, tackled my debt, sacrificed for my dream, and in late 2012, I started building my tiny house.

Life in a tiny house has opened up a lot of possibilities for me. My financial situation has changed drastically because my cost of living dropped so significantly. I took that extra money and started paying off the rest of my debt.

I now have a lot more time to spend, and even better, I have more control over how I spend it. Achieving this dream has given me peace of mind and lowered my stress levels like nothing else could. With no debt, money for a rainy-day fund, and time to think, I feel that I can weather the ups and downs of life better.

Identify Your Goals and What You Need to Reach Them

Before you even start, know what you’re aiming for. Remember my dream of living in a tiny house debt free? That’s pretty specific, and reaching that goal quite literally made my dreams come true. I can now live the slow life I want.

Some questions you might ask yourself

- What’s standing between me and a slower lifestyle less reliant on money?

- Do I have debt that I need to tackle?

- Are there any spending habits I need to change?

- What could my life look like if I conquered my biggest obstacles?

- Where and how do I want to live?

Once you have more clarity on the life you hope to build, make a list of goals and outline steps to help you get there.

Cultivate A Lifestyle Of Slow Spending

Slow spending is really as simple as it sounds. Be slow about spending your money. This is key for a lifestyle that isn’t focused on making as much money as possible. Enjoying life to the fullest doesn’t mean owning everything you could ever want. It means focusing on the true, deeper joys of life over material things.

Avoid Impulse Buys

The key is to remember that buying something new will only make you happy for a matter of moments. A slow money lifestyle offers so much more than that.

“Once you learn to detach happiness from acquiring and owning things, you can focus on what truly makes you happy — and actually achieve that.”

– Peter Walsh, Peter Walsh Design

Avoid Marketing Gimmicks And Spending Triggers

Marketing is definitely working against your slow money journey. Be aware that every store (online and local) is trying to get you to buy things with whatever tricks they can come up with. This is their job. Yours will be to navigate through a sea of carefully displayed items, deals, and sneaky sales pitches while keeping your eyes on the benefits of your slow money lifestyle.

Practical Steps To Slow Your Spending

- Postpone the purchase.

- Unsubscribe from marketing emails.

- Set a no-spend challenge for yourself.

- Turn off or delete shopping apps.

Invest In Your Own Life And Happiness

While some people like to get into venture marketing and stocks, slow living is all about investing in your dream life and your ideal future, taking care to benefit your own personal community as much as possible.

Consider investments that are a little more down-to-earth and tangible than the ones we usually think of. Maybe invest in a home where your family can live the way you want or a piece of property where you can garden or homestead, if that’s your thing. Get creative and invest in things that benefit your slow lifestyle and help make it sustainable.

Embrace A Slow Living Job Mindset And Lifestyle

Remember what is truly important to you. Don’t continue to chase a higher salary just for the sake of making more money. Joy is a factor here. Peace of mind matters. Doing what you love and loving what you do isn’t just a pithy saying. It’s a mantra for those who want to enjoy life and not just make more dollars.

Sometimes accepting a lower salary job in a position that serves your lifestyle and your community is much more rewarding than taking the highest paying job you can find. If a position doesn’t reflect your values or provide you with enough time for your lifestyle and relationships, it’s not a good fit. I don’t care how big the paycheck is.

Start Eating Slowly

I don’t mean that you need to take 10 minutes instead of five to eat your lunch, though that might actually be beneficial too. Slow Food is actually the movement that kickstarted the slow living movement as a whole, and it’s about buying locally grown food and eating according to your local seasons instead of supporting fast food chains and large companies.

At its core, this movement is all about health, local economies, and lowering environmental impact. Buy your produce, meats, and goods locally. Farmers markets and CSAs are great places to help get you started.

“Slow Food unites the pleasure of food with responsibility, sustainability, and harmony with nature.”

– Carlo Petrini, website

Shop Locally

It matters who you support, and not just with your groceries. When you shop in your local community, not only are you supporting the small business owners in your area, you are also paying local sales tax. The taxes you pay at local businesses are reinvested in supporting your community’s schools, roads, and more.

Resources To Help You Achieve Slow Money Success

There are many books out there to guide your slow living journey, but your main source of inspiration really needs to come from yourself. Take time to picture what it is you really want — looking past the fleeting things marketing and other social pressures make you think you want to find what you’re really searching for.

Look around your local community and take notice of the good you could do if you were more plugged in to your feelings and surroundings. What small businesses could you enjoy supporting and what meaningful relationships could grow from being present where you’re at?

Slow Money Books To Read

Your Turn!

- What is your dream lifestyle?

- How could putting your own happiness over social expectations change your view of money?

Leave a Reply