NAVIGATION

A minimalist budget is a financial plan that I’ve adopted over the past several years to help me simplify my spending and focus on the things that are truly important to me. I’ve been able to pay down all of my debt, stack my savings account, and overall have become a lot smarter about the way I manage my finances.

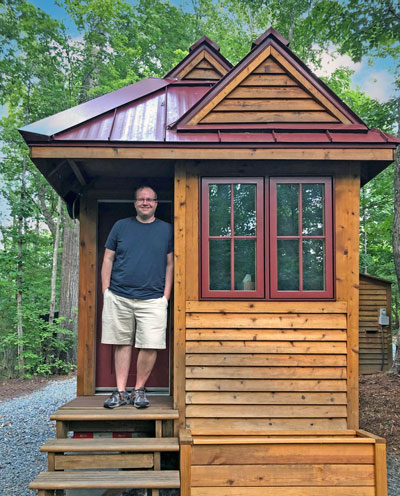

Hi, I’m Ryan

As a minimalist, I try to be intentional about everything I do, including how I manage my money. When I made a budget to reach my minimalism goals, I was more financially secure and felt better about what I was spending my money on.

It’s been over a decade since I first started pursuing minimalism, and I’ve tried minimalist budgeting in a few different ways. While there are many ways to pursue a minimalist budget, the goals generally remain the same: I’m always saving for long-term goals, living intentionally, and decreasing financial worries.

Since I’ve taken up a minimalist approach to managing my finances, I’m more content in what I own and what I spend my money on. Making a minimalist budget that works for me and my lifestyle has opened a lot of doorways into mindfulness and spending where it counts.

Since I’ve taken up a minimalist approach to managing my finances, I’m more content in what I own and what I spend my money on. Making a minimalist budget that works for me and my lifestyle has opened a lot of doorways into mindfulness and spending where it counts.

Leaning into these values has definitely saved me tons of money over the years. As a result, I can better prepare for the future, whether I’m putting my savings into a retirement fund or planning my next travel adventure.

What Is A Minimalist Budget?

A minimalist budget is a budgeting strategy that focuses on reducing unnecessary expenses and prioritizing spending on the things that truly matter. To me, the goal of a minimalist budget is to simplify finances and reduce financial stress, allowing me to enjoy life while I achieve my financial goals.

Why Make A Minimalist Budget?

A minimalist budget can be a baseline to building awareness and confidence in how you spend, save, and improve your overall relationship with your finances. It can also be a strategy that helps you resolve financial debt and take control of your financial wellbeing.

The first time I sat down to map out a minimalist budgeting plan, I was flabbergasted at the amount of pointless, mindless spending I was doing. I immediately saw how those habits were eating away at my income and stability, and it was really an eye-opening moment.

The first time I sat down to map out a minimalist budgeting plan, I was flabbergasted at the amount of pointless, mindless spending I was doing. I immediately saw how those habits were eating away at my income and stability, and it was really an eye-opening moment.

Just by understanding where my cash is going, I can better direct that flow to support the things that matter and spend less on the non-essentials. Regardless of what’s most important to you, taking a thorough report of your spending habits can be a real revelation.

A Minimalist Budget Can Help You Reach Your Goals

Finding a minimalist budget that works with my lifestyle has helped me to reach my financial goal to become debt free and has significantly decreased my financial stressors. A good friend of mine kickstarted a minimalist budget plan, and within just a few months was able to pay off her student debt.

Fight Consumerism With A Minimalist Budget

When it comes to money, there can be a lot of pressure from society and constant advertising that shouts for us all to spend as much as possible. But when we take control of our finances, it can give us a lot of power over that hypnosis.

Making a minimalist budget can help to fight the urge to spend by keeping you focused on the minimalist values of living more simply and intentionally. The consumerism we’re all so accustomed to makes it all too easy to spend and consume at every opportunity, but when you’re being super mindful about your spending, you’re more likely to resist the temptation.

The First Steps To Creating A Minimalist Budget

The first step in creating a minimalist budget is to understand the reason behind the change and why you want to pursue it in the first place. After that it comes down to setting a financial goal, making a plan on how to reach it, and taking a good look at your income and expenses to see where you can make the necessary adjustments.

Be Honest With Yourself

It can be a little scary to acknowledge that you don’t really know what’s going on with your finances, or that you’re not sure how to manage them more effectively. For a long time, I thought that because I could afford my lifestyle, that meant I was being smart about my money — I was definitely off the mark about that.

When I finally stopped defending my spending habits and looked at them for what they truly were, I was able to acknowledge and accept the fact that I really needed a change.

Identify The Why

Before you can nail down a minimalist budget strategy or goal, you’ve got to figure out why you’re doing all of this work in the first place. Identifying your financial values and priorities will lay the groundwork for the rest of your minimalist budget planning.

Right off the bat, I knew that I wanted to spend less of my money on rent and utilities and not be tied down by debts. I wanted more financial freedom, not to mention the ability to lay down at night without my next payment in mind.

Right off the bat, I knew that I wanted to spend less of my money on rent and utilities and not be tied down by debts. I wanted more financial freedom, not to mention the ability to lay down at night without my next payment in mind.

Even if you’re just trying to save some money to go on a great vacation or finally buy your dream car, knowing why you’re making the shift to a minimalist budget will help you honestly identify where you can’t afford to budge and where you can leave a little wiggle room for spending.

Set A Financial Goal

Setting specific goals made it easy for me to track my progress as I worked through my minimalist budget. I found it was much easier to stick to the plan if I set several small goals along the way to my main objective, just to keep myself motivated and feeling like I was making progress.

When creating any goal, it’s a good strategy to make it actionable and break it down into smaller steps whenever possible so that goalposts feel more achievable.

Make A Plan

Once you’ve established your hopes, dreams, and goals for your minimalist budget, it’s time to create a plan that’s going to help you cross the finish line.

Creating a plan of action to implement a minimalist budget is like building a recipe: the ingredients need to be on-hand, prepped, measured, and combined deliberately, or the whole thing falls flat.

Keep The Steps For Starting Your Minimalist Budget Simple

Categorize Your Expenses

Once you’ve identified your financial goals, it’s time to categorize your expenses. Start by listing all of your monthly expenses and sorting them into different categories, such as housing, food, transportation, entertainment, and others.

Evaluate And Reduce Your Expenses

Take a look at your expenses and ask yourself if there are any areas where you can reduce your spending. Look for areas where you can cut back on expenses, such as cutting a streaming service or eating out less often.

Set Spending Limits

After you find places to cut back in your minimalist budget, it’s important to set spending limits for each category. Be realistic and set a budget that you can stick to, but also be flexible and allow yourself some wiggle room for unexpected expenses.

Track Your Spending

It’s important to track your spending throughout the month to make sure you’re sticking to your budget. You can use a spreadsheet or a budgeting app to track your expenses and make adjustments as needed. I sometimes keep a small notebook on hand when I’m traveling or running errands, so I can stay on track without checking my bank account constantly.

Review And Adjust Your Budget Regularly

Your financial situation and priorities may change over time, so it’s important to review and adjust your budget regularly. Check in on your budget every month or quarter to make sure you’re on track to achieving your financial goals. If you’re budgeting with a partner, hold regular budget meetings to stay on the same page.

Practical Tips for Budgeting

It might seem like you need extensive spread sheets or complicated processes for budgeting, but really, it can be a lot simpler than that. There are some practical ways to budget that aren’t overly complex and won’t eat away at your time.

1Intentional Spending

Mindless spending can lead to a lot of money lost. Whether it’s buying more produce than you’ll actually eat in a week or splurging on your umpteenth cup of coffee, impulse buying can get you into trouble.

Being aware of where your money is going is so important. With intentional spending, you’re more mindful when buying things, recognizing their actual value in your life.

Intentional spending can help you put more thought into your purchases, so you end up buying for quality and longevity, rather than satisfying an impulse.

2Identify Needs Versus Wants

When I moved into my tiny home and started living a more minimalist lifestyle, I learned pretty quickly that there wasn’t a whole lot that I actually need. Obviously, basic essentials like food, water, hygiene products, and household items like linens and cleaning supplies are necessary, but the list grows short after that.

Allow some room in your budget for occasional wants and splurges, but keep it to a minimum so you don’t fall off track.

3Ask Questions Before Buying

Before I buy anything, the rules of my minimalist budget require that I interrogate myself a little first by asking a few basic questions:

- Do I need this, or just really want this?

- Do I have somewhere to keep or store this?

- Is this item within my immediate and long-term budget?

A lot of the time, if I still find myself really wanting to pull the trigger on a purchase, I’ll leave it on the shelf and tell myself that if it’s still there the next time, I’ll get it then. More often than not, by the next time I return to that store, I’ve moved on and let go of that desire.

4Spend Less Than You Make

This may seem obvious, but in a world where credit lines are open to nearly anyone, it’s easy to fall into the “buy now, pay later” trap. As a rule of thumb, I never put anything on credit unless it’s a genuine emergency.

5Be Mindful Of The Future

Sure, you’re still living on that payday high, but don’t forget that your phone bill is due in a few days. Also, next week’s groceries won’t pay for themselves. Always be mindful of impending expenses so you don’t accidentally spend money you end up needing later.

6Avoid Financial Distractions

When I became a minimalist, especially when I applied the practice to my budget, one thing I stopped doing is going shopping. Yes, I still make regular runs to the grocery store, but gone are the days of outlet cruising or flea market perusing.

Basically, I only go to a store or shop with a specific purpose, and I don’t let myself get distracted when I’m there. I make a list, stick to it, and bolt. Trust me, it’s easier said than done and takes some serious willpower, but it can be done.

Staying Accountable To Reach Financial Goals

We all have those moments that tempt us. So what can help you from overspending and keep you accountable for spending your money wisely? Sometimes, adding an extra step to spending opportunities will be enough to make you pause and reconsider.

Ways To Stay accountable and stick to your minimalist budget

- Enlist the help of a friend.

- Review daily purchases each evening.

- Call yourself out on and return unnecessary purchases.

- Put necessary expenses like insurance or utilities on auto-pay.

- Don’t store your credit card on shopping sites.

- Leave Post-Its in your wallet, car, and workspace to remind yourself of your goals.

Jump Right In

Getting started with a minimalist budget might feel like a huge undertaking, but it really is — for lack of a better word — simple. More than anything, a minimalist budget is about focusing your energy and your money on the things that mean the most to you.

Getting started with a minimalist budget might feel like a huge undertaking, but it really is — for lack of a better word — simple. More than anything, a minimalist budget is about focusing your energy and your money on the things that mean the most to you.

The longer you wait to begin creating your minimalist budget, the further you get from your goals. There’s no harm in diving right in to minimalist budgeting — there are no contracts, no strings attached. The only things you have to lose here are your excessive spending habits, a pile of debt, and the buyers’ remorse you still have over those hideous throw pillows.

Your Turn!

- Is there something in your life that you just buy out of convenience?

- What’s one financial stressor that you want to eliminate?

Leave a Reply