NAVIGATION

Minimalism saves money through multiple attributes that are naturally frugal, such as having less, but giving away stuff is only a part of the transformation.

Making sure not to start refilling those empty spaces by spending more money and understanding why there is so much stuff in a living space is also a large part of the process.

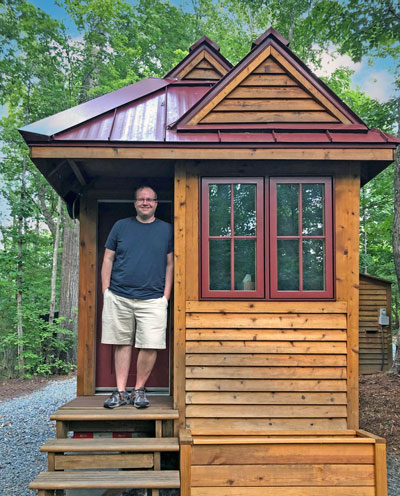

Hi, I’m Ryan

When I started my tiny life journey, I wondered how I would be able to minimize my cost of living and find financial freedom. Over a decade later, I’ve become completely debt free and have substantially cut down my cost of living thanks to a few key practices.

Starting Minimalism And Saving Money

Money isn’t everything, but it does dictate a lot of life’s circumstances. Spending money on what’s valuable and being content with what one has helps to curb mindless spending and focus funds on what’s important. Money saved can add more value to your life when invested in long-term goals.

During the 2008 recession, I found myself being let go from my job that I’d spent years going to school for. I was concerned about the next season in my life, including my financials and what they were going to look like. It was a chance for me to really step back and look at where my money was going, which was mostly paying off my student loans and utilities.

During the 2008 recession, I found myself being let go from my job that I’d spent years going to school for. I was concerned about the next season in my life, including my financials and what they were going to look like. It was a chance for me to really step back and look at where my money was going, which was mostly paying off my student loans and utilities.

I asked myself what I wanted to change and where I wanted to be financially. Once I saw a picture of a tiny home on a trailer, I realized that transforming my life into a simpler one was the answer.

Minimalism isn’t a fast track to solving all of life’s problems, but for me, it was a start. It helped me understand where I wanted to be, how I wanted to progress as a person, and how I wanted to use my money.

There are many reasons why people start with minimalism, and a desire to feel more secure in their finances is one of them. While you may start out with the goal to progress one area of your life, you’re bound to find multiple benefits along the tiny life journey.

How Does Minimalism Save Money?

Saving money relieves financial stress and frees up mental time and energy, leading to a more purposeful life. Minimalism gives an opportunity to save money for the long haul and create a more intentional lifestyle that encourages prioritizing the most important parts of life.

Intentional Spending

For me, adopting minimalism means practicing a lot of intentionality, and this especially applies to finances. Being intentional about money makes it clear what is actually worth our hard-earned dollars and what adds value to our lives. Instead of buying whatever first sparks interest, taking a moment to reflect and ask a few questions can help save money.

An important first step is understanding why money is spent. Identifying if a shopping trip is made out of boredom, out of convenience, or to fill an emotional void is necessary to change current financial habits into better ones.

An important first step is understanding why money is spent. Identifying if a shopping trip is made out of boredom, out of convenience, or to fill an emotional void is necessary to change current financial habits into better ones.

Another key piece of advice is to avoid going to the store without a plan. Practice intentionality by creating a list and a budget so you can focus on getting items that are needed and curb impulse purchases.

One of my friends who used to struggle with impulse purchases developed a routine for when she went shopping. When she found herself wanting to buy something that wasn’t on the list, she would pause and ask herself a couple of questions: “Do I need it?” and “What value would this add to my life?”

Then she’d go home and after a few days, she’d ask the same questions: “Do I need it?” and “What value would this add to my life?” Then if her answers were still clear, she’d commit to the item and purchase it.

Focus On Needs Over Wants

Having a specific financial end goal will make it easier to understand the why behind saving. Going a step further and sharing that goal with a trusted person to help with accountability is a good way to stay motivated to save instead of spend.

Avoid Buying Convenience

When we’re stressed, it’s common to find ourselves doing things for a quick fix. But when practicing minimalism, there’s more time for mindfulness and intentionality with how your time is spent, which helps cut down those situations where convenient options are needed.

Eliminating habits like eating fast food, paying for a grocery delivery, or buying snacks at a convenience store can help to keep money inside your wallet. While a temporary impulse might seem like a good idea, it can cost a pretty penny.

Buying For Quality And Longevity

It might seem like choosing the cheaper option is a tried-and-true way to save money, but actually paying more on a better product upfront might save more money over time.

I realized pretty early on in my simple living journey that paying for higher quality items initially almost always gets you a product will last longer. This means you’ll spend less money buying multiples of an inferior product that’s cheaper in quality and breaks easily.

Less Stuff Is More Money

Downsizing can mean more than just decreasing the number of possessions you own. It can also mean downsizing to a smaller place and cutting back on those duplicate purchases.

Less Need For Space

I know that not everyone on the minimalism journey wants to end up in a tiny home, but with less stuff around, you may decide that you’d like to relocate to a smaller apartment that can help decrease the cost of rent and utilities. Also, less stuff present means that there is less need for multiple furniture items or storage containers.

Fewer Duplicate Purchases

Minimalism also helps to bring awareness of what items we have and take inventory on what we need. By going through belongings to simplify and resisting the urge to compile more stuff, we have a better idea of what we actually own and find contentment in what we do have so that we don’t accidentally buy duplicate purchases.

How Minimalism Can Make You Money

Now that we’ve talked about saving money, what about making some extra cash? When getting rid of items, they don’t have to just go in the donation box or the trash. There’s also an option to try and sell those items still in good shape.

Items To Sell

There are a variety of old items that could be sold to make money, from big pieces such as furniture to smaller items like books. And of course, you can also sell new or lightly used items that are in good condition.

I recognize that selling items can be mixed bag. When deciding what to sell, consider what items are worth the hassle. Sometimes it’s easy to get caught up in the worth of something rather than simply giving it up for clarity in life and peace of mind.

Here are some of ideas of items to sell

- Name Brand Clothes

- Exercise Equipment

- Unused Sports Equipment

- Musical Instruments

- Books

- Videogames and Consoles

- Old Kitchen Appliances

- Collectable Items (Posters, Trading Cards, etc)

Places To Sell To

Finding places to sell items to can be a tedious part of the process. Trying secondhand website platforms such as Facebook Marketplace and eBay are digital options. Brick-and-mortar second-hand stores or garage sales could also be worth a try.

Financial Benefits From Minimalism

Applying minimalist practices like focusing on needs over wants and deciding to focus on the most important things in life, whether it be relationships or passions, can help you spend money on what’s really worth it.

What I’ve heard from so many people who have adopted minimalism is that when they switched their way of thinking about money and spending, that’s when they saw a big difference in their financial growth.

What I’ve heard from so many people who have adopted minimalism is that when they switched their way of thinking about money and spending, that’s when they saw a big difference in their financial growth.

Minimalism can help you pursue financial goals, be intentional with your money, and encourage spending on value and quality to save money over time. The main idea here is that you purposely plant money in areas of your life that you find valuable so that they can grow.

Your Turn!

- What are some purchases you make regularly for convenience that you could cut out?

- What’s one financial goal you have and what will keep you motivated to reach it?

Leave a Reply