NAVIGATION

Many of us are brought up believing that acquiring more, more, more is the ultimate goal — I used to believe this too. It takes self-awareness to break the cycle of excess and recognize that simple, slow living is the key to achieving happiness and peace. Lifestyle creep is a threat to that peace — often coming after an increase in income or earning — but I’ve learned that it can be avoided with attention and care.

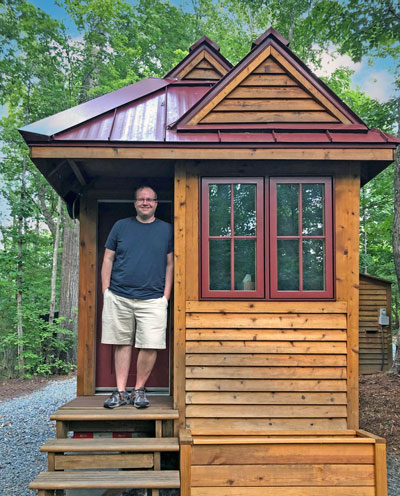

Hi, I’m Ryan

After a decade of experience, I’ve learned that part of being a minimalist means staying on top of where my money goes. By keeping lifestyle creep at bay, I have been able to maintain my standard of living while staying prepared for unexpected circumstances.

What Is Lifestyle Creep?

Lifestyle creep, sometimes called lifestyle inflation, is what happens after a person reaches financial stability, and slowly increases their level of consumption as a result.

I’ve seen it happen lots of times — with greater resources at your disposal, you gain the ability to upgrade certain aspects of your life, sometimes in ways that are so gradual, it’s hard to notice it happening.

I’ve seen it happen lots of times — with greater resources at your disposal, you gain the ability to upgrade certain aspects of your life, sometimes in ways that are so gradual, it’s hard to notice it happening.

While the meaning of lifestyle creep often refers to tangible space and objects, it can also bleed into the intangibles – like time, and the ways you spend your time.

Once you upgrade your house or vehicle, for example, you are committed to working to maintain that level of consumption.

I intentionally avoid significant upgrades to my space because I know that what I’ve got works well for me.

Why Is Lifestyle Creep Bad?

Lifestyle creep is bad because it can – almost without your realizing it – trick you into believing that more is what will make you happy – more space, more vehicles, more stuff.

You’re working more, you have more in the bank, why not upgrade your vehicle or home? Why not eat out for a few more meals a week, instead of cooking? Haven’t you earned it?

You’re working more, you have more in the bank, why not upgrade your vehicle or home? Why not eat out for a few more meals a week, instead of cooking? Haven’t you earned it?

The reason is that, when you do these things, you end up working more to enable them, and sometimes even borrowing from your own future. I’ve spent a long time out of the fast lane, and each year convinces me more and more that the minimalist mindset is best for my overall wellbeing. I think of something my elders used to say: Just because you can, doesn’t mean you should.

Benefits of Avoiding Lifestyle Creep

The main benefit of avoiding lifestyle inflation is that you stay in control of your life, instead of letting the circumstances of your life control you. If you get a raise at work, instead of immediately upgrading your vehicle, or going on a luxurious trip, think about maintaining your exact budget, and putting the extra cash into an emergency fund or investments, which will prepare you for the future. If you find yourself jobless, like I did when I experienced an unexpected layoff, you won’t panic, because you’ll have a cushion in the bank.

Starting to live a minimalist lifestyle will serve you well for the rest of your life. For example, as you approach old age, when you scale back or stop working, you will not have to make a major downgrade to your lifestyle, because you never lived beyond your means.

Starting to live a minimalist lifestyle will serve you well for the rest of your life. For example, as you approach old age, when you scale back or stop working, you will not have to make a major downgrade to your lifestyle, because you never lived beyond your means.

If you are successful in avoiding lifestyle creep, it can free up your life in other ways. If you decrease your budget and set up a solid emergency fund, you may be able to reduce your working hours and have more time. What’s more important, updating your throw pillows every season, or having extra hours each week for your favorite pastimes?

It’s true, our society often reminds people to “treat yourself” — but I don’t mean you shouldn’t reward yourself for a job well done. It just doesn’t have to be with stuff. After I reach a milestone, I sometimes reset by trying a new hike I’ve been meaning to attempt, or taking a day trip to visit a friend I haven’t seen in a while. I like to think of treats as experiences rather than objects.

Understanding The Signs Of Lifestyle Creep

The signs of lifestyle creep often appear when spending becomes excessive in multiple areas of life, and you’ve boosted spending on things when it wasn’t actually necessary. While it’s certainly okay to enjoy your extra income, lifestyle creep happens when the lines between comfort and luxury become blurred.

I like to think of it as a set of stairs. You may go up one step if you absolutely need to upgrade something, but if you find yourself wanting to climb several steps at once, step back and remind yourself of your priorities.

Examples of Lifestyle Creep

Remember, you don’t need to do something just because you see others doing it or because the world around you seems to encourage it. I find that if you’re staying aware, it’s possible to identify the beginnings of lifestyle creep:

Lifestyle Creep Examples

- Dipping into your savings several months in a row

- Replacing a vehicle with something larger when a simpler one meets your needs

- Spending more than usual on vacations

- Paying extra for convenience with no added value (think pre-cut veggies)

- Mindless spending or making impulse buys without a second thought

- Eating out more than you cook at home or buying coffee every day

- Losing track of monthly subscriptions, or paying for ones you don’t use

- Quickly replacing broken things that can easily be fixed

How To Beat Lifestyle Creep Before It Derails You

It’s surprisingly simple to avoid lifestyle creep because, if you think about it, you don’t have to do anything at all. You can keep using the same vehicle or bike for as long as they last, or wearing your clothes for another year even if they aren’t the latest styles.

If your expenses stay static but your income increases, or if you receive an inheritance or unexpected gift, apply the extra income to your future financial freedom, instead of treating it as cash to burn. A minimalist approach to finances can help you live well on less money.

If your expenses stay static but your income increases, or if you receive an inheritance or unexpected gift, apply the extra income to your future financial freedom, instead of treating it as cash to burn. A minimalist approach to finances can help you live well on less money.

One interesting exercise is to do a “happiness audit.” This can be a great way to check in with yourself on what actually makes you happy, as a reminder of what to prioritize. I did this at the start of my tiny life journey, and I often suggest it to friends. A happiness audit can help you realize that what makes you happy isn’t a new blanket or pair of shoes, but financial freedom and time for family, hobbies, or community activities.

Use Simple Formulas To Keep Spending In Check

So, how do you keep your expenses static? You may already be tracking your monthly expenses, which is great. If you aren’t, today is a great day to start. Many folks abide by a 50/30/20 budget, with 50% of your income going to necessities, 30% to discretionary spending, and 20% to debt reduction or savings.

![]() This approach often works well, but I suggest even more creative ways to challenge your status quo, like seeing what you can do without or even doing a low buy year.

This approach often works well, but I suggest even more creative ways to challenge your status quo, like seeing what you can do without or even doing a low buy year.

Who knows? You may write out a budget and see that you can even reduce your working hours. The 40-hour workweek is something many have been able to step away from. Increased freedom and flexibility will prove more valuable than trinkets that tend to clutter your space and mind.

Apps To Automate Budgeting And Stay Within Limits

The technology around budgeting and spending gets better by the day. A number of budgeting apps can link to your bank or credit card accounts to show exactly where your money is going every month. Doing an analysis of your spending will help you see the categories where you can cut back and reduce expenses.

There are even apps that help you identify recurring expenditures like subscriptions to streaming or other services. Taking a look at these may help you reduce your budget by cutting out things you barely use, or helping you realize that what you do use isn’t worth the dollars you spend on it.

Stay Out Of The Stores

I used to love wandering the aisles of stores, thinking about what I’d like to buy next. This set me up to be in a constant cycle of wanting things I didn’t have, feeling disappointed, and having a less positive outlook on my life. If you can minimize time spent in stores, you will be more likely to avoid this mental spiral.

Reduce Grocery Spending With A Garden

Try growing your own food. You don’t have to go from zero to a 2-acre garden overnight. Every tomato you grow in a container on your porch is one you don’t have to buy.

Don’t Revamp Your Wardrobe Every Year

Consider a capsule wardrobe. Once I scaled down my wardrobe to save costs, I also enjoyed other benefits, like more efficient mornings with less time spent thinking about what to wear.

Can You Reverse Lifestyle Creep Once It’s Started?

It is possible to reverse lifestyle creep once it’s begun. You can take steps every day to downshift your lifestyle, or simplify your life and reduce expenses in the process. This will have an immediate effect on your monthly budget and a ripple effect going forward. Maybe you’re getting a coffee to go every morning or bringing pastries to the office. Next time, try making beverages and treats from what you have on hand, or even bringing seasonal treats from your garden.

There’s no specific time to start checking yourself for lifestyle creep, but sooner is generally better. You don’t want to find yourself on day one of retirement, only to discover that your initial retirement goals don’t fit your current inflated lifestyle.

There’s no specific time to start checking yourself for lifestyle creep, but sooner is generally better. You don’t want to find yourself on day one of retirement, only to discover that your initial retirement goals don’t fit your current inflated lifestyle.

As middle-aged and senior folks prepare for retirement and downsizing, tackling lifestyle creep head-on is a smart first step. When one is free of unnecessary items and spending, everything else falls into place.

I found that once I really started focusing on these things, my enthusiasm for the whole process increased. Minimizing my expenses led to increasing my financial stability, which increased my security, peace – and mental wellbeing.

Your Turn!

- If your wages increased tomorrow, where would your spending change?

- Where are areas in your budget that you can reduce regular spending?

Leave a Reply